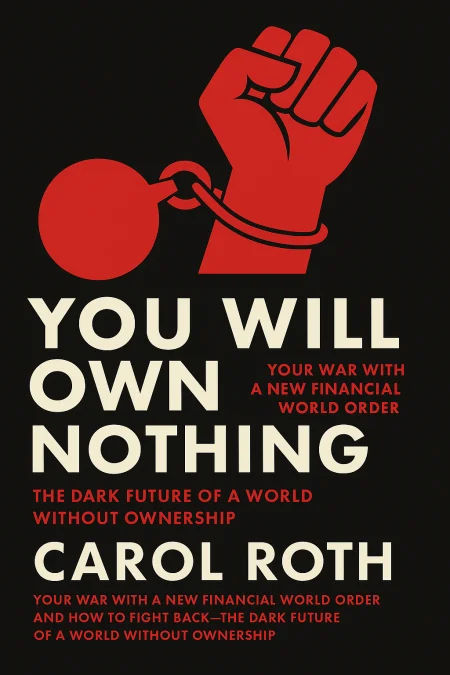

You Will Own Nothing

Your War with a New Financial World Order and How to Fight Back

Book Edition Details

Summary

In a startling vision of tomorrow, Carol Roth exposes a paradigm where the wealthy orchestrate a reality that seems straight from dystopian fiction: a world where ownership vanishes and contentment is manufactured. As the powers that be conspire to keep the populace asset-free, Roth meticulously unravels the tangled web of global financial manipulation. From the corridors of Wall Street to international policy chambers, discover how strategic alliances and economic trends threaten to erode personal wealth and liberty. With razor-sharp insight, Roth not only challenges the status quo but arms you with the tools to safeguard your financial future. Are you prepared to navigate this uncharted economic landscape and reclaim control before it's too late?

Introduction

A systematic transformation of the global economic order is underway, one that fundamentally threatens the principle of private property ownership that has underpinned Western prosperity for centuries. This transformation operates through interconnected mechanisms of monetary manipulation, technological surveillance, and corporate consolidation that systematically redirect wealth from individual ownership toward institutional control. The convergence of central bank digital currencies, social credit systems, environmental social governance frameworks, and subscription-based economic models creates a comprehensive architecture designed to eliminate personal asset accumulation while establishing permanent dependency relationships between citizens and elite institutions. The analysis employs a multi-dimensional approach that traces historical patterns of wealth concentration, examines contemporary policy mechanisms, and reveals the ideological frameworks driving these changes. By investigating everything from currency debasement to digital surveillance, from housing policies to corporate governance structures, a clear pattern emerges of coordinated efforts to ensure that future generations will possess no meaningful assets or economic independence. The evidence demonstrates that what appears as disconnected market forces and policy initiatives actually represents a systematic campaign to concentrate wealth and power among a narrow elite while transforming the general population into perpetual renters of everything from homes to software to transportation. Understanding these mechanisms requires recognizing how crisis narratives justify extraordinary interventions, how technological convenience conceals control systems, and how seemingly beneficial programs serve as vehicles for unprecedented wealth transfer. The investigation reveals that current trends, if left unchecked, will result in a neo-feudal society where individuals own nothing while remaining dependent on institutions that control all essential resources and services.

The Architecture of Control: Social Credit and Digital Surveillance

Social credit systems represent the merger of technology and authoritarianism, creating comprehensive frameworks for monitoring and controlling individual behavior through economic incentives and penalties. These systems assign numerical scores to citizens based on their actions, associations, and expressed opinions, then use these scores to determine access to services, employment opportunities, and financial resources. The Chinese model demonstrates how such systems can effectively eliminate dissent by making ideological compliance economically necessary for survival, while Western implementations operate through seemingly voluntary corporate platforms that achieve similar results through coordinated exclusion. The implementation follows a predictable pattern, beginning with reasonable applications such as credit scoring and fraud prevention, then expanding to encompass political opinions, social associations, and lifestyle choices. Digital platforms collect vast amounts of behavioral data through routine interactions, creating detailed psychological profiles that enable precise prediction and manipulation of individual actions. This surveillance appears voluntary while being practically unavoidable, as digital systems become essential for employment, commerce, and social participation. The infrastructure supporting these systems includes digital identity frameworks, biometric databases, and real-time monitoring networks that track movement, purchases, communications, and associations. Payment processors, social media platforms, and financial institutions coordinate to exclude individuals from economic participation based on political opinions or social behaviors, effectively creating a parallel legal system that operates through private corporate policies rather than constitutional due process. Once established, this architecture can be rapidly repurposed to serve different political objectives, making resistance increasingly difficult as dependency on digital systems deepens. The ultimate goal extends beyond behavioral modification to the complete elimination of economic independence. By tying access to employment, housing, transportation, and financial services to social compliance scores, authorities can control every aspect of individual existence without resorting to overt force or legal proceedings, creating a form of soft totalitarianism where formal freedoms exist but practical liberty disappears.

Currency Debasement and the New Financial World Order

The systematic destruction of currency value represents one of the most effective methods of wealth confiscation in human history, allowing governments and central banks to appropriate private assets through the seemingly technical process of monetary policy. The Federal Reserve's unprecedented expansion of the money supply, particularly following the 2008 financial crisis and accelerating dramatically during the COVID-19 response, has fundamentally altered the relationship between work, savings, and wealth preservation. This monetary manipulation transfers purchasing power from savers and wage earners to asset holders and financial institutions, creating a hidden tax that disproportionately affects those least able to protect themselves through alternative investments. Historical precedents from the Roman Empire to modern economies demonstrate how currency debasement consistently precedes societal collapse and wealth concentration among elite classes. Modern central banks have abandoned any pretense of maintaining stable purchasing power, instead embracing policies of perpetual inflation that make traditional saving impossible and force individuals into speculative investments. The transition away from gold-backed currency eliminated the final constraint on monetary expansion, enabling unlimited money creation that benefits those with first access to new money while impoverishing those who receive it last through the Cantillon effect. The international implications of dollar debasement threaten the entire post-World War II financial order, as foreign nations increasingly question the wisdom of holding reserves in a currency subject to political manipulation. The weaponization of the dollar through sanctions and asset freezes has accelerated the search for alternative reserve currencies and payment systems, potentially ending the exorbitant privilege that has allowed Americans to live beyond their means for decades. The emergence of competing currency blocs and the increasing use of commodities in international trade signal the approaching end of dollar hegemony. Modern Monetary Theory provides intellectual justification for unlimited government spending by claiming that currency-issuing governments face no financial constraints, ignoring the real-world consequences of currency debasement including asset price inflation that prices ordinary citizens out of home ownership and wealth accumulation. The result is a system where financial assets appreciate rapidly while wages stagnate, creating an insurmountable barrier between asset owners and wage earners that eliminates traditional pathways to middle-class prosperity.

Corporate Capture and the Technocratic Power Grab

The concentration of economic power within a handful of multinational corporations has created a parallel governance structure that operates outside traditional democratic constraints while wielding unprecedented influence over individual lives. Environmental Social Governance frameworks serve as mechanisms for coordinating corporate behavior toward predetermined social outcomes while concentrating control over capital allocation in the hands of large institutional investors. These frameworks operate by establishing metrics and standards that companies must meet to access capital markets, effectively creating a parallel regulatory system that bypasses democratic oversight and accountability. The implementation of ESG standards enables large asset management firms to exercise voting control over vast portions of the economy through their management of index funds and retirement accounts. This concentration of voting power allows a small number of individuals to influence corporate policies across entire industries, directing capital away from traditional energy sources, manufacturing, and other sectors that support middle-class employment toward speculative technologies and financial instruments that serve elite interests rather than productive economic activity. Technology platforms have systematically converted ownership models into subscription arrangements across multiple sectors, from software and entertainment to transportation and housing. Companies explicitly state their intention to eliminate private ownership of durable goods, while streaming services replace media ownership with temporary access rights that can be revoked at any time. This transformation reduces consumers from owners of assets to perpetual renters dependent on corporate platforms, ensuring that individuals never acquire lasting wealth while creating permanent revenue streams for corporate owners. The data collection capabilities of these organizations provide unprecedented insight into individual behavior, preferences, and vulnerabilities, enabling sophisticated manipulation and control strategies that exceed anything previously imagined by totalitarian regimes. The combination of behavioral data, artificial intelligence, and economic leverage creates possibilities for social engineering that operate through market mechanisms rather than government coercion, making resistance appear as voluntary market choices while being practically impossible to avoid.

Fighting Back: Strategies to Preserve Wealth and Freedom

Resistance to the emerging control systems requires both individual preparation and collective action, focusing on the preservation of economic independence and the restoration of genuine property rights. The most immediate priority involves diversifying wealth away from easily monitored and controlled digital assets toward tangible resources that retain value independent of government policy or corporate cooperation. Physical precious metals, productive real estate, essential commodities, and practical skills represent forms of wealth that cannot be eliminated through database manipulation or policy changes, providing protection against currency debasement and offering tangible ownership rights that exist independently of institutional permission. The development of parallel economic systems offers the potential to maintain commerce and wealth creation outside the controlled mainstream infrastructure. Local currencies, barter networks, and direct exchange relationships reduce dependence on centralized payment systems and financial institutions that can be weaponized against individual interests. Community-supported agriculture, local manufacturing, and regional supply chains create economic resilience that cannot be disrupted by distant authorities or corporate decisions, while building networks of like-minded individuals creates mutual support systems that can resist social credit mechanisms and economic exclusion tactics. Political engagement must focus on the restoration of constitutional limitations on government power and the enforcement of antitrust laws against corporate monopolies that have captured regulatory agencies and eliminated market competition. Legal challenges to administrative overreach have shown increasing success as courts recognize the extent to which regulatory agencies have exceeded their constitutional authority, providing mechanisms for individuals to challenge government takings, regulatory restrictions, and due process violations that undermine wealth accumulation and asset protection. Education and awareness campaigns must expose the true nature of current economic policies and their long-term consequences for individual prosperity, as the complexity of modern financial systems allows destructive policies to operate with minimal public understanding or opposition. Clear explanations of monetary policy, regulatory capture, and wealth transfer mechanisms can build the political support necessary for meaningful reform, while financial independence requires reducing dependence on institutions that implement ESG policies and developing skills that provide economic value independent of corporate employment structures that can be compromised by political pressure.

Summary

The systematic elimination of private property ownership represents the most significant threat to individual economic freedom since the rise of totalitarian governments in the twentieth century, operating through the apparent mechanisms of free markets and private enterprise to achieve comprehensive wealth concentration among elite institutions. The convergence of monetary manipulation, digital surveillance, corporate consolidation, and social credit systems creates a framework for wealth extraction that operates across all sectors simultaneously, transforming citizens from property owners into permanent renters while establishing dependency relationships that eliminate economic independence. Understanding these mechanisms provides the foundation for developing defensive strategies that can preserve individual wealth and freedom through asset diversification, community organization, political engagement, and the development of parallel economic systems that operate outside centralized control. The window for effective resistance remains open, but requires immediate recognition of the stakes involved in this fundamental restructuring of economic relationships and coordinated action by individuals who understand that current trends lead inevitably toward a neo-feudal society where freedom exists only for those who control essential resources and infrastructure.

Related Books

Download PDF & EPUB

To save this Black List summary for later, download the free PDF and EPUB. You can print it out, or read offline at your convenience.

By Carol Roth